Hedonova: Investments beyond stocks

Think of Hedonova as a mutual fund for alternative assets. We invest in equipment and litigation finance, international real estate, music royalties, agriculture, startups, carbon credits, and more.

Loved by investors

4.8| Reviews100+

4.9| Reviews100+

4.6| Reviews10+

4.8| Reviews10+

What we offer

Hedonova simplifies investing by eliminating the need for individual research and market monitoring.

What are alternative assets?

Most investor portfolios are made up of three key components: equity assets (like stocks), fixed-income assets (bonds), and cash or cash equivalents, like money market funds. Any other assets that don't fit into traditional financial investment categories like stocks, bonds, or cash investments are known as alternative investments.

Learn about alternative assetsFund facts

SEC-registered

Hedonova Advisors is an SEC-registered Investment Adviser (CRD #324941).

Withdraw anytime

No lock-in period. No exit fee. Invest and redeem any time you want.

$10,000 minimum investment

The first investment should be $10,000 or more. No minimum on additional investments.

Tax pass-through

Hedonova offers a tax pass-through. In simple terms, pay taxes only in your country.

Performance

Hedonova has consistently delivered strong risk-adjusted returns since its inception, outperforming the S&P 500 index.

Hedonova vs S&P 500 since inception

- Hedonova

- S&P 500

39.65%

IRR

A performance metric that evaluates the fund's potential profitability based on investment duration, cash flows, and overall returns.

NaN%

Alpha over S&P 500

The absolute excess annual returns for the Hedonova portfolio over the S&P 500 are determined after adjusting for market-related volatility and random fluctuations.

47.08%

CAGR

A performance metric that quantifies the fund's annualized return, taking into account compounding effects, essential for evaluating investor performance.

Annual returns

- Q1

- Q2

- Q3

- Q4

Monthly returns

- Hedonova

- S&P 500

Risk-adjusted performance

Rolling 90-day sharpe ratio

The Sharpe ratio measures the risk-adjusted return of an investment by subtracting the risk-free rate from the portfolio's return and dividing by its standard deviation. A higher ratio indicates better risk-adjusted performance. Ratios below 1 are considered suboptimal. 1-2 is good, and above 2 is excellent. Ratios below 0 suggest the risk-free asset outperforms the investment. It helps investors understand if the returns justify the risks taken. Here, it has been computed monthly.

Rolling 90-day correlation

The rolling 90-day correlation chart shows the connection between Hedonova's fund performance and a benchmark, typically a stock market index, across a 90-day rolling period. The correlation coefficient varies from -1 to 1, with values closer to 1 indicating a strong positive correlation, values closer to -1 indicating a strong negative correlation, and values near 0 suggesting minimal correlation.

Portfolio composition

Balance held in banks and liquid treasuries to be used for future investment opportunities and redemptions.

Diversified across the world

What do we offer?

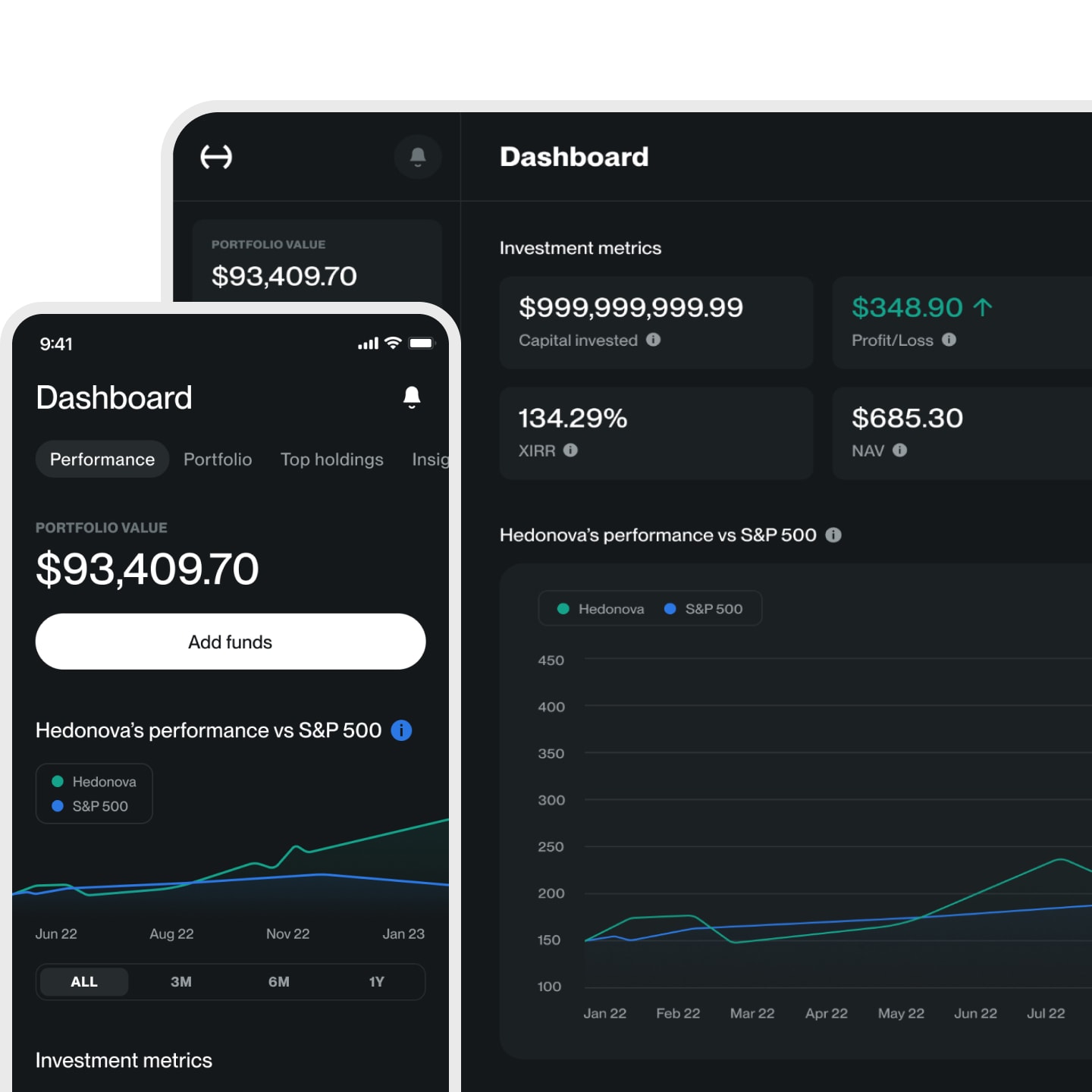

Real-time tracking

You can conveniently track your investment on your web dashboard or mobile apps, add more funds, make withdrawals, and perform all usual functions with just a few clicks.

Regular updates

You will receive weekly performance updates and comprehensive investment updates via email every quarter.

24*7 support

Our team is available 24*7 to support investors through various channels, including chat, email, phone calls, and WhatsApp.

Investment professionals

Our dedicated team offers support with portfolio management and related services. We do not offer tax advice. Please consult your tax advisor for personalized guidance.

Bespoke service

Clients have the option to reach out to a live representative at any time for assistance with various services and support inquiries.

Governance

Auditor

Haynie & Company

Auditors ensure we follow the best accounting practices, supporting our dedication to excellence in alternative investments. They also assess our valuation methods and their implementation.

General Counsel

Genevievette Walker-Lightfoot

Counsels guide us through regulations, ensuring high compliance standards and conformity to laws, positioning us as a promising alternative investment fund.

Bankers

HSBC / Citi

Our alternative investment fund's global operations benefit from partnerships with major banks, ensuring the secure custody of client capital and access to strong treasury operations.

Administrator

CITCO

Fund administrators are responsible for the operational and administrative side of the fund.

Meet some of our people

Alexander Cavendish, the Founder and CEO of Hedonova, holds degrees in applied mathematics and computer science from Zurich ETH. He has excelled in the financial sector at UBS, focusing on derivative modeling and investment banking for European deep tech and fintech companies. Alex excels in alternative investments and portfolio management, blending academic insights with practical finance expertise.

Read Interview

Suman Bannerjee is the Chief Investment Officer of Hedonova. With over a decade's experience in emerging markets and alternative investments, including managing a $5 billion portfolio at Millennium Partners, Suman leads the team in making investment decisions across diverse asset classes while optimizing returns, managing portfolios, and considering tax implications.

Read Interview

Jennifer Robble is the Chief Operating Officer of Hedonova. She holds an MBA from INSEAD and a Bachelor of Arts (BA) degree from The George Washington University. With over a decade at Deutsche Bank, she excels in managing client relationships in OTC Clearing, Futures, FX, and Fixed Income Prime Brokerage. Her expertise includes alternative investments, portfolio management, and regulatory engagement.

Read Interview

Genevievette brings extensive expertise in compliance, risk management, and regulatory affairs. As the Managing Member of The Law Offices of Genevievette Walker-Lightfoot, P.C., she ensures SEC-regulated entities adhere to compliance standards. With ties to FINRA and previous positions at the Federal Reserve Board and the U.S. Securities and Exchange Commission, she is listed among The Hedge Fund Journal's Top 50 Women in Hedge Funds.

Read Interview

Tariq is the Chief Financial Officer of Hedonova. He is a seasoned financial professional and CAIA charter holder with over two decades of experience investing in Middle East markets and offshore capital raising. As an INSEAD and Chicago Booth alumnus, Tariq was pivotal in founding Mubadala and as a principal investor at Investcorp, specializing in alternative assets. With rich experience, he adeptly navigates financial complexities.

Read Interview

Ameer is a seasoned finance specialist, excelling in investor relations and wealth management. Leveraging his background at Goldman Sachs and Citi, he thrives in investor communications and financial optimization. With a Master's in Finance from the National University of Singapore and a Bachelor's in Economics from The London School of Economics, he excels in investor relationship management.

Read Interview

Chitra previously worked as a Research Software Engineer at Microsoft specializing in deep learning, natural language processing (NLP), and automated machine learning (AutoML). Proficient in Python and C++, she actively contributed to machine learning projects. With a BTech in Computer Science from the prestigious Indian Institute of Technology, her expertise significantly boosts Hedonova's financial technology initiatives.

Read Interview

We are global

We are remote first, with offices in the USA, France, Singapore, and Switzerland.

Taxed as capital gains

For US investors

For non-U.S. investors

Common tax-related questions